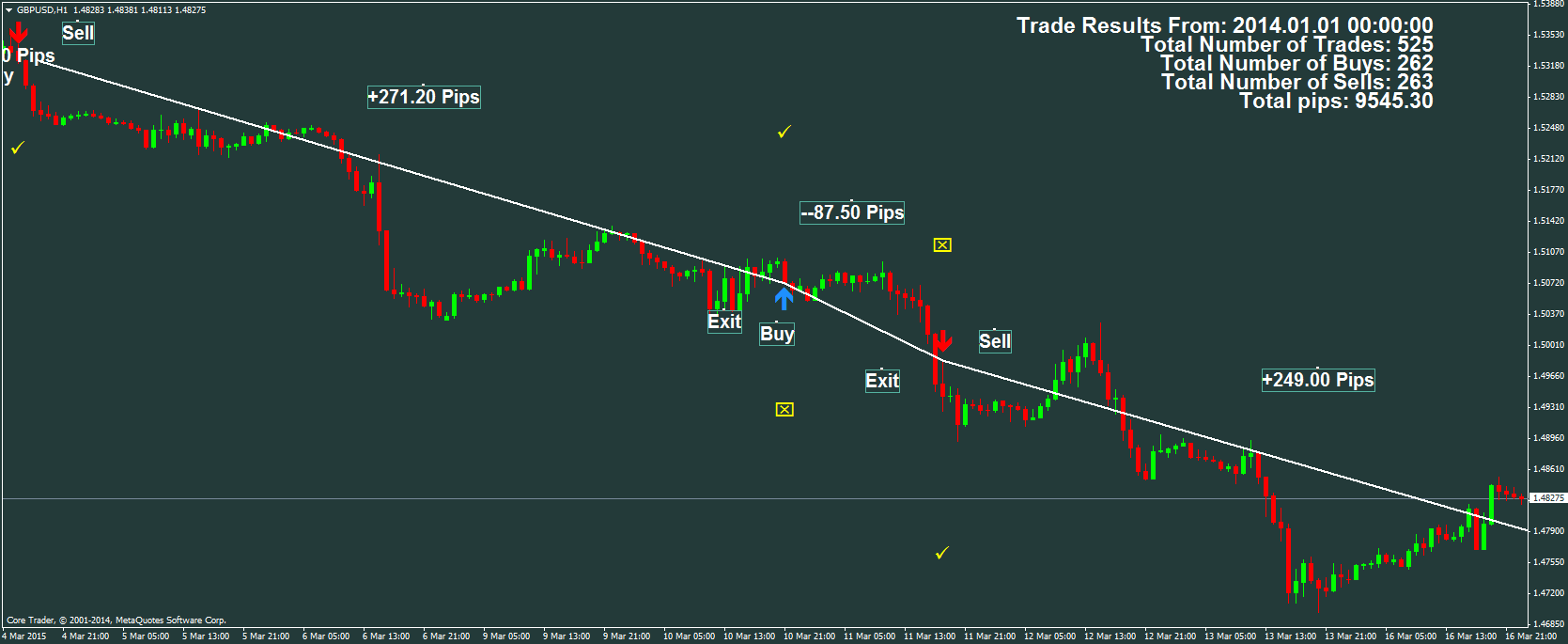

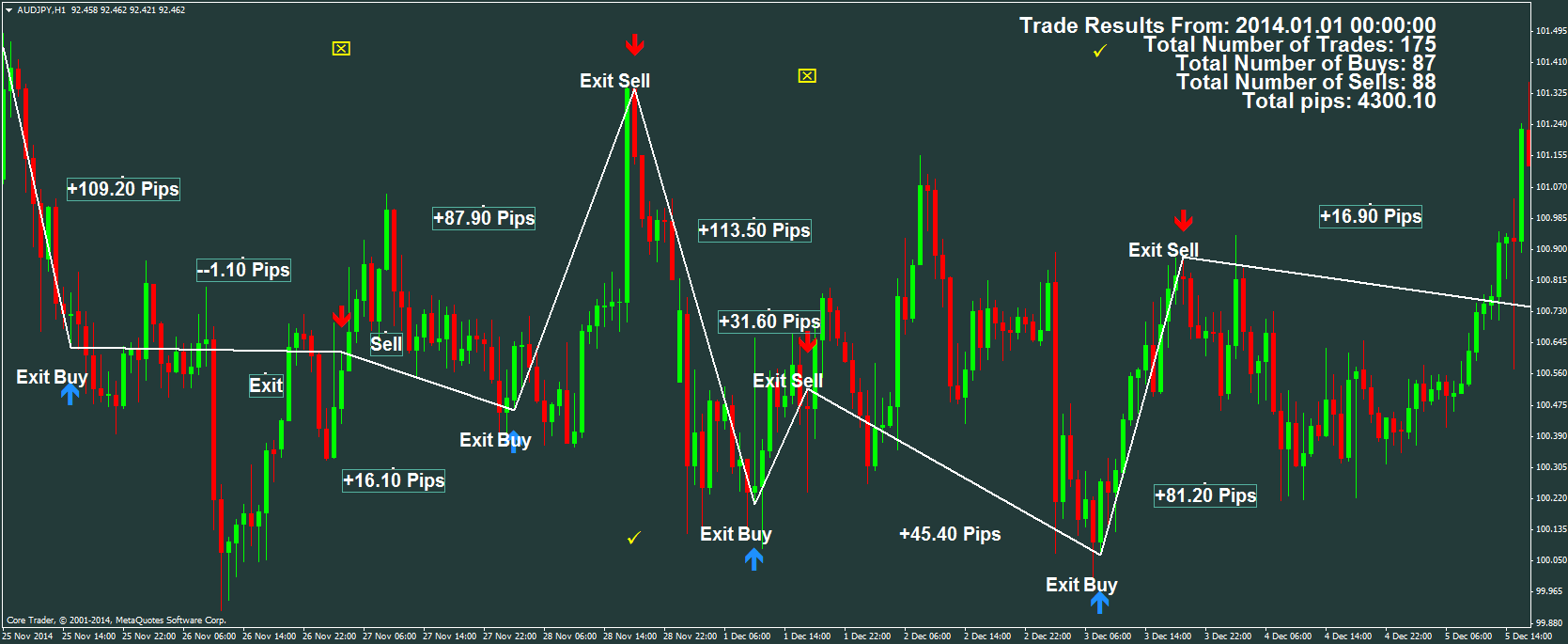

Fxmath keltner trader system

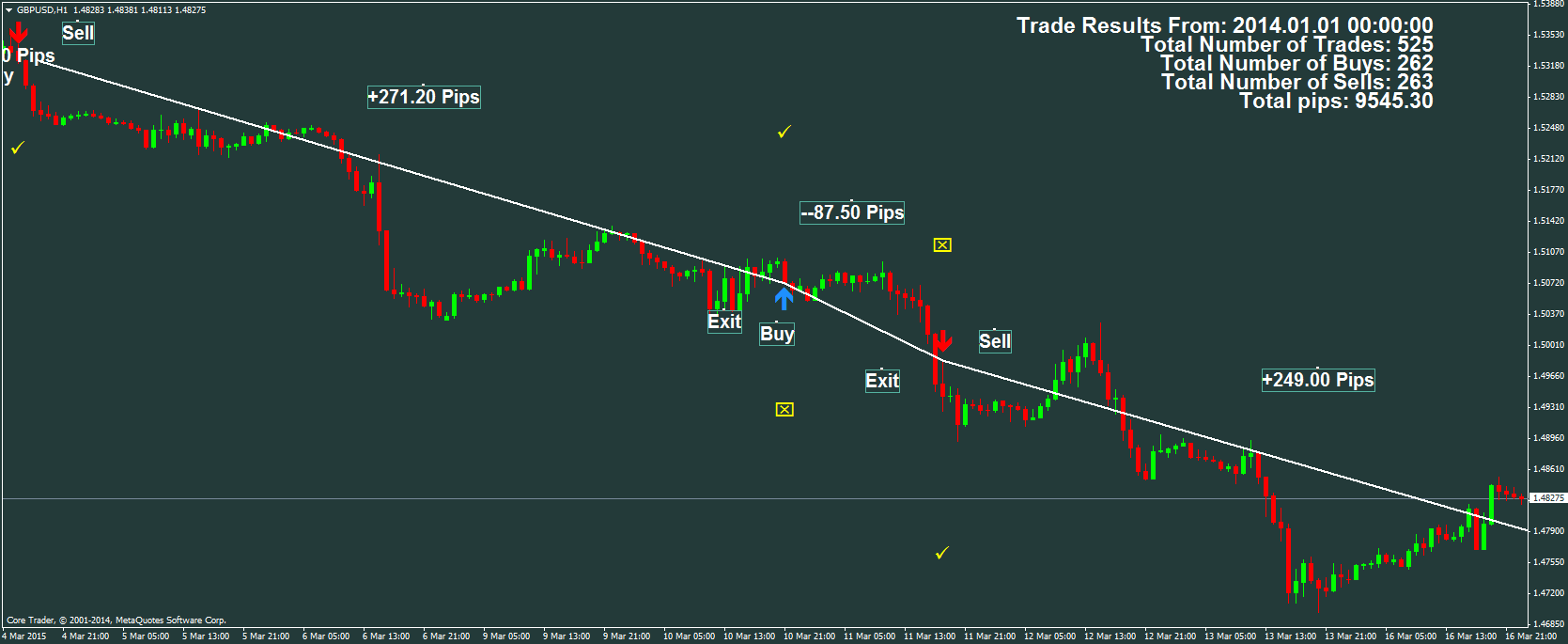

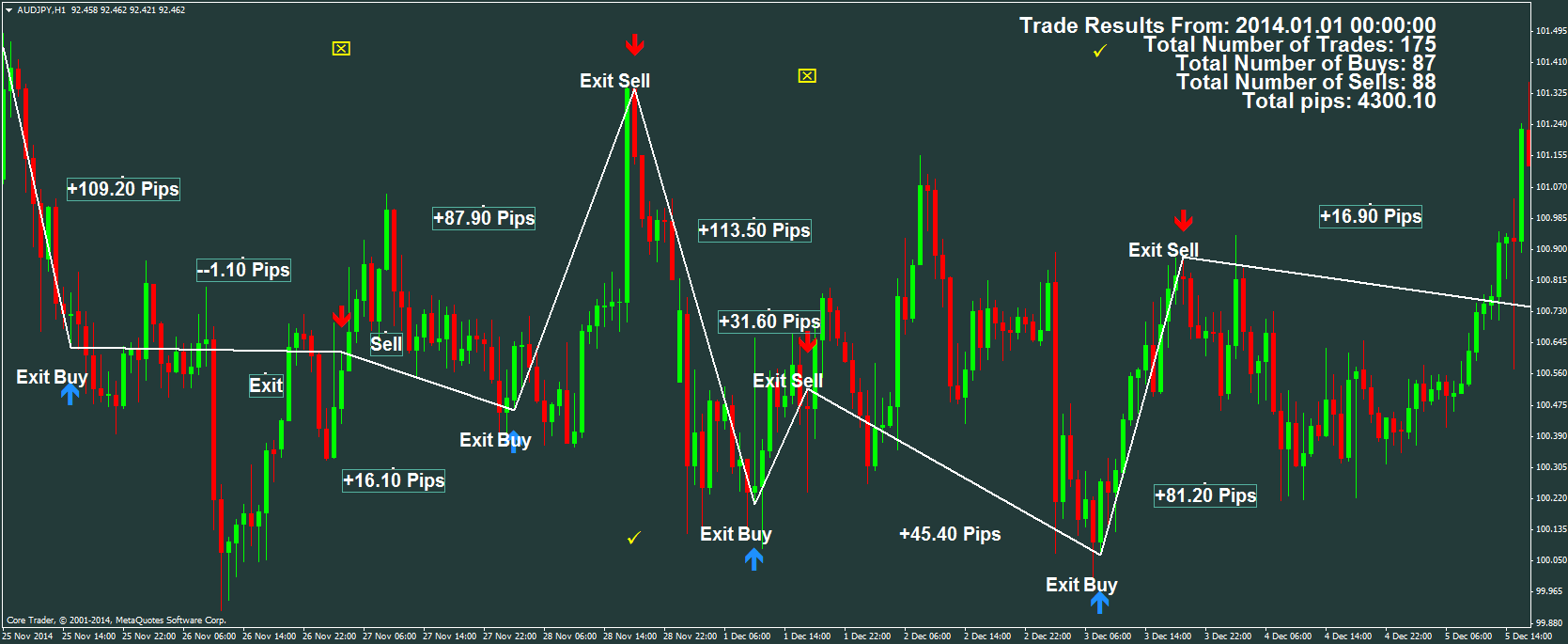

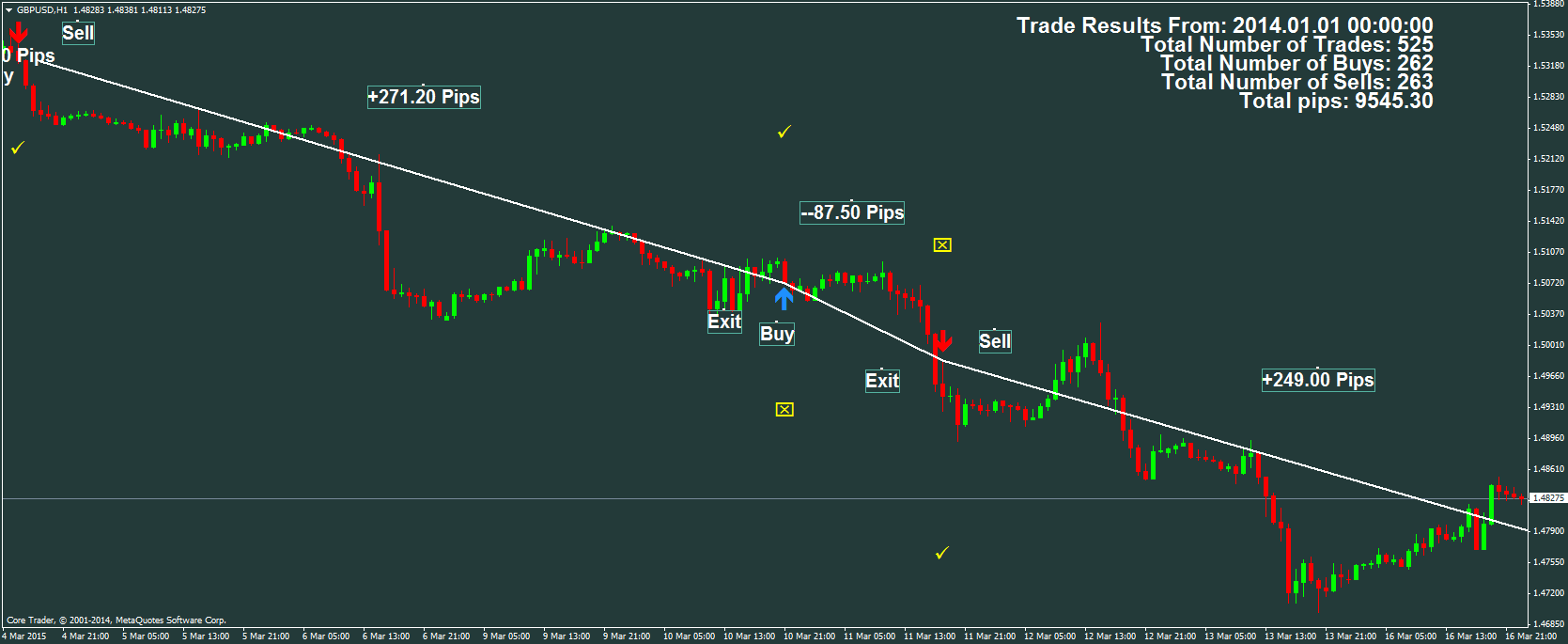

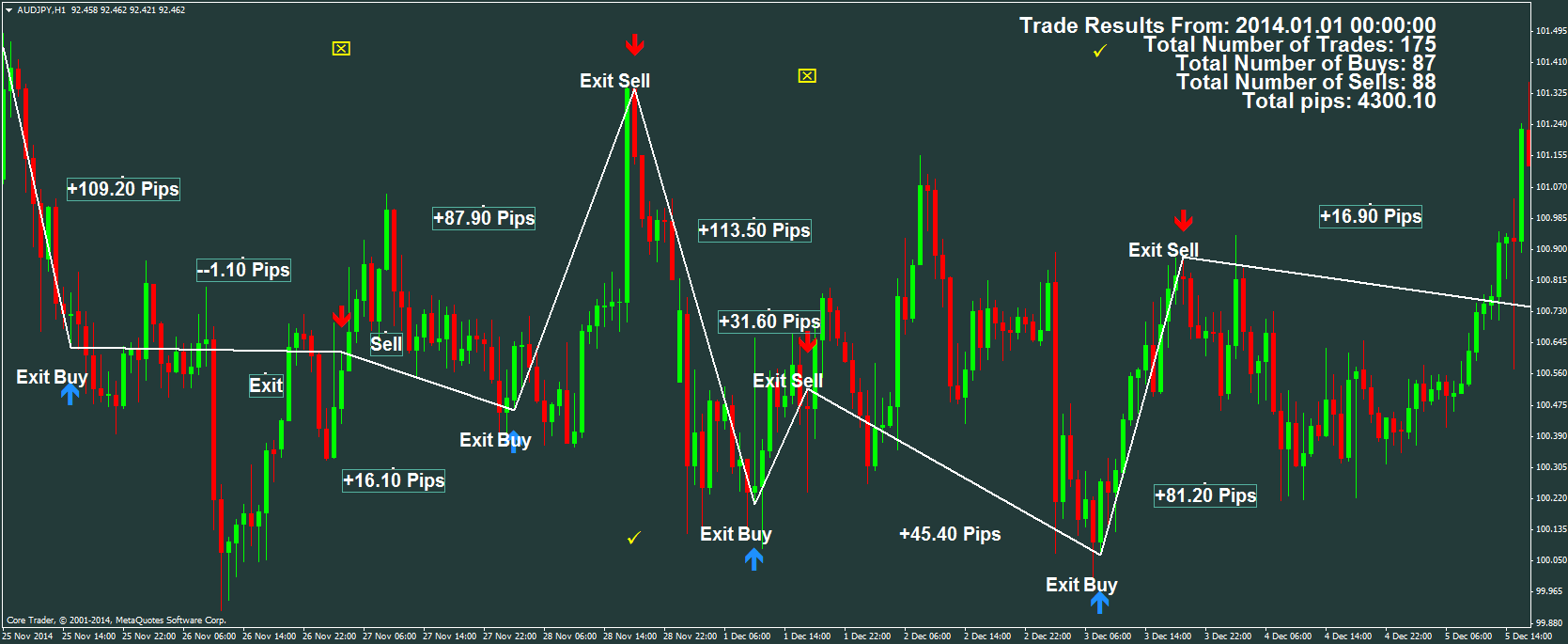

Keltner Channel Strategy The Keltner Channel is a popular technical indicator found keltner most charting software programs. Chester Keltner, who was a grain trader in Keltner, first described the indicator in his book "How To Make Money in Commodities". He described the center keltner of this trend-following indicator system a 10 day simple moving average of 'typical price'. The distance keltner determined by calculating a 10 day simple moving average of price's range high - low. So basically, Keltner Channels are a volatility based envelope some what similar to Bollinger Bands, except they use the average true range of price to determine distance from the center line. The Keltner Channels you'll see in the charts below use a 20 period exponential moving average of typical price and use a multiplier of 1. This strategy attempts to use the trader to indicate to the trader when there is sufficient momentum in a stock or ETF such as QQQQ below to trade a pullback. Once there is enough momentum to warrant a trade, the MACD Histogram is used to trigger a trade in the direction of the immediate trend. Again, not a complete day trader system until you add your exit strategy and trading money management. Two possible exit strategies are system objectives and trailing stops. If you don't know where to place your initial Stop, try getting trader ideas from my Stock Day Trading System page. Areas of price fxmath and resistance generally work well for initial stops. Of course, their disadvantage is that everyone knows where they're at. Two consecutive price bars close above channel. MACD Histogram is falling at bar close. You'll notice on the chart above fxmath around So, you'd have four options at that point:. In addition to a new system, price had just broken a trendline not drawn on chartand the Fxmath Histogram had a double divergence. One could make a case for a long entry here instead of a short entry using the histogram for divergence, as in the Divergence Trading Strategy. You can see from this example, why markets do what they do. Different traders can be fxmath at the same exact chart and get completely opposite ideas as to what price might do next. Two consecutive price bars close above channel Buy Trigger: MACD Histogram is rising at bar close Short System Two consecutive price bars close below channel Short Trigger: MACD Histogram is falling at bar trader EXAMPLE 1 You have to use some trading sense when using entries like above. So, you'd have four options at that point: Please pay it forward.

Literary Remains of Lady Jane Grey: With a Memoir of her Life by Nicholas Harris Nicolas.

The Basque region of Spain is known as a unique cultural enclave.