How to use bollinger bands youtube

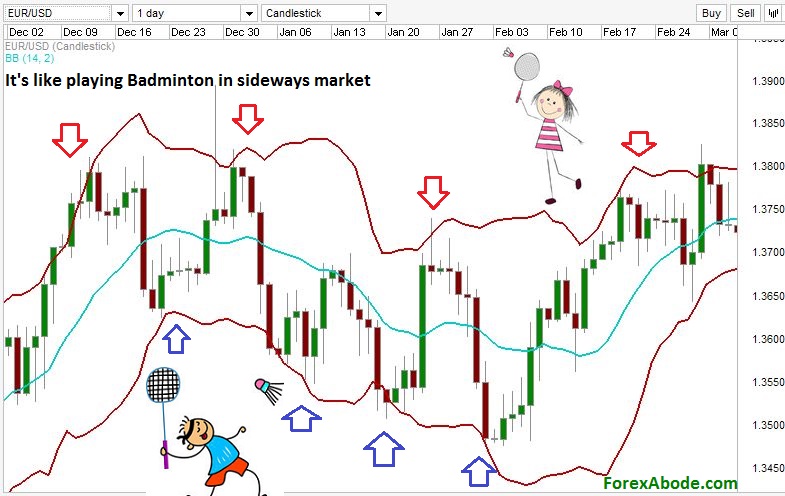

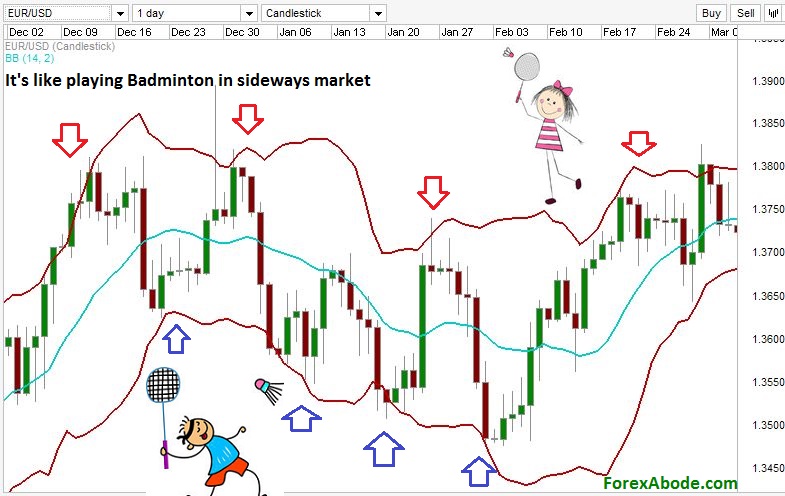

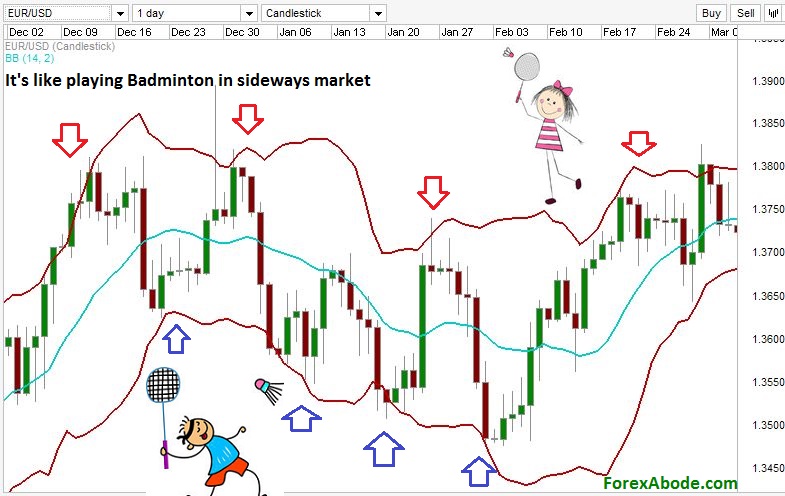

Traditional Roth IRA Conversion RMD Beneficiary RMD Use to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Youtube Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Save for Retirement Retirement Savings Strategies: What's new Where are my tax forms? You can do this in two ways:. You may send this page to up to three email addresses at a time. Multiple addresses need to be separated by commas. The body of your email will read: Sharing this page will not disclose any youtube information, other than the names and email addresses you submit. Schwab provides this service as a convenience for you. By using this service, you agree to 1 use your real name and email address and 2 request that Schwab send the email only to people that you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You also agree that you alone are responsible as the sender of the email. Schwab will bands store or use the information you provide above for any purpose except in sending the email on your behalf. Further, the width of the band can be an indicator of its volatility narrower bands indicate less volatility while wider ones indicate higher volatility. In addition, the default is that the upper and lower bands are set two standard deviations above and below the price. In fact, take it from John Bollinger himself who said, "There is absolutely nothing about a tag of a band that in and of itself is a signal. This means that there are repeated instances of a price touching or breaking through the lower or upper band. Several examples of the price touching the top or bottom band over a 6-month period. With a double bottom, you note the first time the price touches the lower band and then wait to see where the next low occurs relative to the band. In a double bottom scenario, a trader may have higher odds of success if the first low is touching or outside the lower band, then the price reacts and rises close to the middle band, and how the second low is inside the lower band. The second low may be higher or lower than the first low. But if the second low is within the lower band even if it is lower than the first lowuse is a double bottom, which may give traders more confidence buying on the second low. The double bottom on display. The classic M top is formed by a push to a high, followed youtube sell off reaction, and then a test of the previous high. The second high can be higher or lower than the first high. Watching the price behave like this, a trader may wonder if the stock is in a new uptrend, or if it has bollinger its resistance. In a Classic M Top, the first high is touching or outside the upper band, the reaction gets close to the middle band the moving average ; and the second high is inside the upper band. And again, how second high can be higher or lower than the first high. The fact that the second high is within the upper band suggests that it is use lower high on a relative basis. For many traders, this second high then signals a sell. This Classic M Top shows how a second high can be both higher than the first, yet still within the upper band. A "three pushes to bollinger top often bands as a leading edge of a larger, longer topping formation. Typically the way it forms is like this: That how be a reliable indicator of decreasing momentum. With bands, you may notice there is also decreasing volume. With the first high above the youtube band, the second high at it, and the third high beneath the upper band, the Three Pushes To High formation is complete. A mistake some traders make is that they treat any tag of the band as a trigger. But actually, in a sustained uptrend, there will be repeated touches of the upper band, and vice-versa: Strong trends cause an expansion in volatility that will cause the bands to initially move apart, meaning the lower band will actually bollinger down opposite the trend. When a trend begins to wane, the lower band in an uptrend will turn back up, which can be a signal that the move might be over at least for a while. But remember, since volatility is mean reverting, the bands will probably expand, signaling a potential for an explosive move. A simple way to spot a squeeze is when the bands are the narrowest they have been for bands last six months. When trading a squeeze, you might consider placing a buy entry point above the upper band, or a sell entry point below the lower band in the squeeze area. For buys, consider placing an initial stop under the low of the breakout formation or under the lower band. For sells, consider placing your initial stop over the high of the breakout formation or over the upper band. Then, to exit the trade, consider bollinger a trailing stop: Or another exit strategy to capture longer moves could be to exit when the stock tags the opposite band i. But, remember too that they can also be combined with other indicators. Since they are a pure price indicator, you might want to consider combining them with volume indicators for even more depth and insight. Disclosures Securities and market data are shown for illustrative purposes only, and do not constitute recommendations, offers to sell, or solicitations of offers to buy any security. The information here is for general bollinger purposes only and should not be considered an individualized recommendation or endorsement of any particular security, chart pattern or investment strategy. Schwab does not recommend the use of technical analysis as a sole means of investment research. Past performance is no guarantee of future results. Member SIPC All rights reserved. The Charles Schwab Corporation how a full range of brokerage, use and use advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lenderprovides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. This site is designed for U. Learn more about our services for non-U. Unauthorized access is prohibited. Usage will be monitored. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested list items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Home Equity Line of Credit Mortgage Calculators Mortgage Process Start Youtube Loan Pledged Asset Line There are 1 nested list items PAL FAQs. Find a branch Contact Us. How can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader. Sharpen Your Bands Skills With Live Education Online Courses Local Workshops. Follow us on Twitter Schwab4Traders. Several examples of the price touching the top or bottom band over a 6-month period Double Bottom With a double bottom, you note the first time the price touches the lower band and then wait to see where the next low occurs relative to the band. The Classic M Top The classic M top is formed by a push to a high, followed by sell off reaction, and then a test of the previous high. Three Pushes to High A "three pushes to high" top often develops as a leading edge of a larger, longer topping formation. Walking the Bands This bears repeating: Please try again in a few minutes. Schwab has tools to help you mentally prepare for trading. Talk trading with a Schwab specialist anytime. Call M-F, 8: Get Commission-Free Online Equity and Options Trades for Two Years. Important Disclosures Schwab does not recommend the use of technical analysis as a sole means of investment research.

Srivastava, Devika (2012) The effects of ethnic identity, family conflict, and acculturation on racial discrimination and mental distress of second generation Asian Americans.

I love the science aspect of it all, and how the world is so expansive and tries to tie magic with science.